Whilst we transition to more efficient superyachts and future green energy solutions, carbon offsetting can today make a difference in reducing CO2 emissions from the fuel used onboard. Of course, the fuel used is only one element of the emissions produced during the lifecycle and operation of a superyacht but, at least it is one that is easily measured and understood. However, the value and effectivness of carbon offsets is a little more opaque and needs careful consideration.

In brief, carbon offsets are a way of compensating for CO2 or, other Green House Gas (GHG) emissions, by investing in projects that remove CO2 from the atmosphere e.g. forestry sequestration, or projects that reduce future CO2 emissions such as energy efficiency or renewable energy.

There are basically two types of major offset programs: –

-

- Compliance – carbon offset programs run by a number of Governmental bodies such as the United Nation’s Clean Development Mechanism (CDM) which overseas carbon offsets under the Kyoto Protocol and the EU Emissions Trading Scheme (ETS).

- Voluntary – carbon offset programs run by a number of independent non-governmental organisations (NGOs) such as The Gold Standard and the American Carbon Registry.

It is the Voluntary programs/market that allows organisations, individuals and superyacht owners or their representatives, to purchase carbon offsets.

Whilst carbon offsets can generate measurable and long lasting GHG reductions and socioeconomic benefits, both the Compliance and Voluntary models have been coming under increased scrutiny and criticism for a multitude of reasons and concerns:-

- They essentially allow those who can afford it to continue polluting and do not result in a reduction.

- They can distract individuals or organisations from making important investment and changes necessary to reduce their emissions.

- Lack of a robust regulatory framework and transparency.

- Their effectiveness has been called into question; a 2017 EU study of offsets found that 85% of the projects covered by the analysis are unlikely to deliver “real, measurable and additional reductions”, a March 2019 Bloomberg article suggested a number of European airlines had paid to have forests planted in poor countries but were cut down by local authorities.

- Some offset projects may have harmed local communities e.g. the Bujagali Dam in Uganda.

It is therefore essential when considering the purchase of carbon offsets, you do your research to ensure that it ultimately achieves your goals of offsetting and/or reducing your GHG emissions. And, better then me trying to encapsulate all the issues in this article, the guide below – which can be downloaded – is an excellent resource that explains in detail what to consider and how to select the right carbon offsets and providers and is well worth taking the time to read.

An important point is that offsets, when used, have to be retired – the actual process depends on the carbon offset programs registry. Once an offset is retired it cannot be transferred or used again – effectively taken out of circulation. This means many projects have a finite number of offsets they can sell. And, given some of the concerns in the guide such as double counting, and accounts in the press of unscrupulous sellers, it is important that a broker or retailer you choose has transparent and robust procedures that allow you verify the offset has been allocated to your account only and, that when the offset is retired you are able to confirm that a ‘retirement certificate’ has been issued against that offset.

Some retail providers even go so far as to detail how much of the carbon offset cost is allocated to the project and the americancarbonregistry.org provides a public registry of offset projects that have been registered with them – both these examples help improve transparency and confidence in carbon offset programs.

Whilst retail providers will be the most common source for buying offsets, for larger superyachts, fleets or management companies, there is also the option of using a Carbon Trading Exchange where you can buy/sell CDM or Gold Standard program offsets, providing better prices and ultimate control over the purchase and retirement of your carbon offsets.

When quantifying CO2 emissions of diesel fuel used on Superyachts it depends on the quality and density of the fuel used. For example, IMO use a factor of 3.206 g CO2/g fuel for MDO – therefore 100,000L of MDO density 0.880 is equivalent to approx. 280t of CO2. You would therefore need to purchase and retire 280t of carbon offsets. And, by adding an extra 40% of carbon offsets, you can help towards the IMO goal of reducing CO2 emissions across international shipping by at least 40% by 2030.

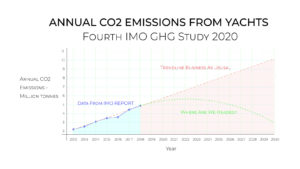

In the future it is likely that carbon offset programs will be phased out as they are progressively replaced by regulations and/or taxes. For example, a carbon tax on shipping has long been under consideration and a recent IMF report: Carbon Taxation for International Maritime Fuels: Assessing the Options, suggests that for the IMO to reach its carbon reduction targets, a tax of US$75 per CO2 tonne (US$240 per tonne of MDO) would be required by 2030, rising to US$150 per CO2 tonne (US$480 per tonne of MDO) by 2040 – this would make voluntary offsetting look cheap in comparison!

So, whilst carbon offsets may not be perfect, they can, if chosen wisely and properly managed, help owners and charterers concerned about the environmental impact of superyacht use, make a positive contribution towards the goal of responsible and sustainable yachting.