Whenever I talk to owners and clients, the subject of running costs and budget always comes up. I always advise, it is a fundamental tool for measuring the financial performance of the yacht but, like fine art, requires careful crafting and curation to be of value, and this always comes with a caveat – there is no ‘one size fits all’ model.

That “10% of the value of the yacht” as often cited, can turn out to be a significant underestimation that can lead to financial shock and a negative ownership experience; with some owners withdrawing from the industry because of it.

The cost of running a Superyacht is significant, with annual costs ranging from €2M for a 50 metre yacht and up to €20M+ for some of todays 100m+ yachts. With such significant expenditure it is essential to have financial controls in place and a well developed, and monitored budget is one of the most valuable tools available.

A budget must; forecast the amount and timing of funds, measure performance and instill accountability and transparency into the fiscal management of the yacht.

Developing The Budget

A realistic budget takes time and effort to develop. The schedule of accounts must reflect the expenditure accurately and, as mentioned, this is unlikely to be achieved from ‘an off the shelf budget’ for an identical or similar sized yacht without adapting it to the owner and use.

The process of developing a budget requires proactive collaboration and consultation between the captain, the yachts team, and the owner, his family office, and/or management company. It will be important to understand how the yacht is to be used as this knowledge will help with the accuracy of the budget.

“The process of developing a budget requires proactive collaboration”

Knowing the cruising plans and use of the yacht e.g. one or two seasons, stand-by or scheduled use, crew employment terms and conditions, standard of maintenance, along with preferences for economy or speed, marina or anchorage, food and drink, etc., will help in creating a workable budget. There is also the question of private or charter, which although adds income to the yacht – not guaranteed and often over estimated – also has cost implications; extra hours on engines and systems, general wear and tear and crew issues.

The Head’s of Departments (HOD’s) – engineering, deck, interior and catering – should be involved in the development process and should have responsibility for managing their departmental budgets. This helps improve the accuracy of the budget, and serves as a motivational tool by giving senior crew ownership and accountability of their area of expertise.

As yachting is perhaps, the ultimate discretionary expense, and a big part of its appeal is the freedom and spontaneity it affords, one should understand that the budget is subject to many variances, some which can be significant depending on how plans change.

In addition a yacht is made up of complex systems and equipment and operates in a hostile environment. This will inevitably result in breakdowns or incidents that cannot be readily modeled into the budget, other than trying to mitigate a potential shortfall by maintaining a contingency for unexpected events.

Maintenance

During the life of the yacht, the reality is that repair and maintenance costs will increase, and how well a yacht is maintained will have a major impact on use and reliability, as well as the resale value and/or charter appeal.

A new yacht in its first year is covered by shipyard warranty, so associated repair costs tend to be low – although beware of the travel and subsistence costs that may be levied as these can be high if there is a large amount of work carried out remote from the shipyard – in later years, these costs will progressively increase as the operating hours take their toll on equipment, systems and machinery.

Future expenses that I would categorise as Periodic Maintenance, such as dry docking and shipyard periods should also be considered.

A Private or Commercial Yacht 12 PAX or less, will require two dry-docks in a five year cycle for works such as – Class survey, antifouling paint, checking and maintenance of shafts, stabilisers, rudders, bowthruster, anchors and cables, hull and ships side valves. It is also likely that the hull and/or superstructure may need a repaint within that period, again a cost that should be budgeted for. The cost of servicing engines and generators – excluding the normal checks and oil/filter changes – is often something that is overlooked and is dependent on use and hours. As an example a service contract by one engine manufacturer in 2013 for maintaining 2 x 300kW engines over 16,000 hours was around €400k, and 2 x 3600kW engines over 12,000 hours was in excess of €500k.

“An owner should decide if he wants he to spread these over a 5 or 10 year cycle”

Periodic Maintenance costs are cyclical and spread over a number of years and there are a number of ways of accounting for these. An owner should decide if he wants he to spread these over a 5 or 10 year cycle, or whether he would prefer each year to be independent, with Periodic Maintenance added separately.

Upgrades and New Equipment

Capital expenditure for new equipment and/or upgrades should also be accounted for as a separate category as it falls outside the normal operational expenses of the yacht.

Macro to Micro Expense Categories

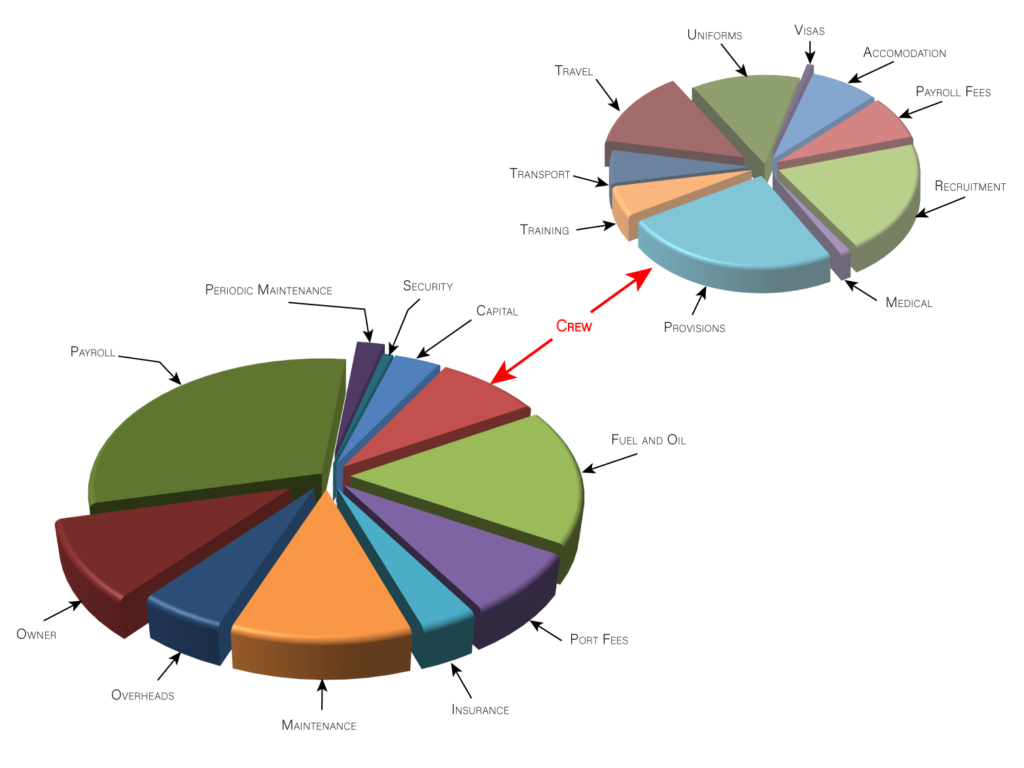

Following good accounting practices there should be sufficient cost centres, sub-catagories and account codes – the metrics – to enable a thorough analysis of expenditure. For example with suitably defined crew costs, the budget could be used to highlight and identify the real cost of high crew turnover by spikes in recruitment fees, uniform, repatriation/travel costs, etc., and provide the financial imperative to resolve the situation.

Lumping costs together limits transparency and value of the budget and should be avoided.

A ‘Dynamic’ Document

Inevitably the budget will go through a number of versions as it is developed, reviewed and finessed, before finally approved by an owner. And, once implemented, the budget will need to be effectively monitored to ensure the defined financial targets are being met and any variances are brought to the owner’s attention without delay.

Although the budget is an important aid it is only part of the picture, it must also be backed up with other controls and procedures in order to effectively manage the yachts finances. These include such things as format and frequency of reporting, purchase order request and approval process, and setting expenditure limits and authority.

As many of the suppliers and service providers we rely on in the industry tend to be small businesses, the effect of delays in the payment cycle can be profound. And, for the yacht, it can create reputational damage – yachts end up at the back of the queue or, ignored completely, for services and supplies which, in high season can impact on the owner and guest experience. Having a budget that effectively forecasts cash flow can ensure funds are available to make prompt payments – although sometimes, unfortunately, slow payment is the policy of an owner or his financial team.

Finally, it should be understood that the budget is a dynamic document and will need to be continuously reviewed and improved upon over time, and changed as circumstances dictate. If crafted and curated well, the budget provides an owner with a valuable tool in understanding and controlling costs, minimising financial shock and, improving the ownership experience.